When it comes to financial calculations, understanding simple interest is essential. Whether you’re calculating the interest on a loan, an investment, or saving money, simple interest plays a fundamental role in finance. But how can you make these calculations easier and more accessible? Enter the Simple Interest Maths Genie – a tool designed to simplify the process of determining simple interest. In this article, we’ll dive into the concept of simple interest, explore how the Simple Interest Maths Genie works, and answer common questions surrounding the topic.

What is Simple Interest?

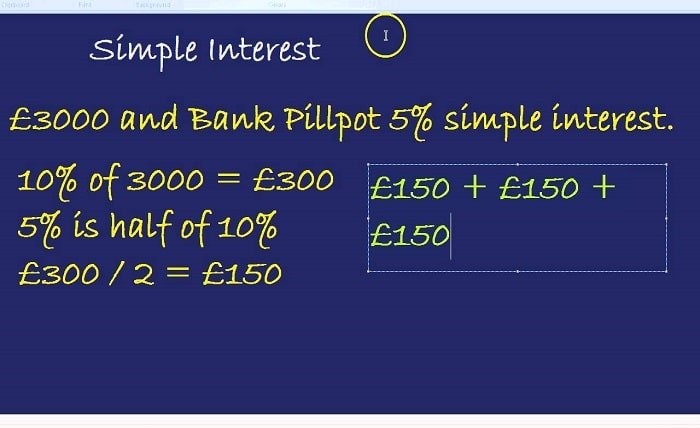

Before we explore the Simple Interest maths genie, it’s important to grasp the fundamentals of simple interest itself. Simple interest is a way to calculate interest on a principal amount over a period of time. Unlike compound interest, which is calculated on the principal and accumulated interest, simple interest is only calculated on the original principal.

For example, if you invest $1,000 at a rate of 5% per year for 3 years, you will earn $50 each year, and the total interest at the end of 3 years will be $150. Simple interest helps individuals and businesses understand how much money they will pay or earn over time.

The formula for simple interest is:

Simple Interest (SI)=P×R×T100\text{Simple Interest (SI)} = \frac{P \times R \times T}{100}

Where:

- PP is the principal (initial investment or loan amount)

- RR is the rate of interest per year

- TT is the time period in years

The Role of the Simple Interest Maths Genie

The Simple Interest Maths Genie is a tool designed to simplify the process of calculating simple interest. This tool helps individuals and businesses by automatically generating simple interest values, saving them time and effort. It takes the headache out of manual calculations, providing instant results at the click of a button.

Using the Simple Interest Maths Genie, you can input the principal amount, interest rate, and time period to calculate the interest quickly. It eliminates the need for complex manual calculations and ensures accuracy. Whether you’re a student learning about simple interest or a financial professional, this tool can be a game-changer in your financial toolkit.

How the Simple Interest Maths Genie Works

The Simple Interest Maths Genie is based on the simple interest formula mentioned above. Once you input the values for the principal, rate of interest, and time period, the tool does the math for you. It uses the formula:

Simple Interest (SI)=P×R×T100\text{Simple Interest (SI)} = \frac{P \times R \times T}{100}

The tool will then calculate the interest amount and display the result. Additionally, many versions of the Maths Genie can also provide the total amount to be repaid or earned by adding the principal to the interest. This makes it easier to understand the total financial commitment or gain.

For example, if you want to calculate the interest on a $2,000 loan at a 6% annual interest rate for 4 years, you would enter these values into the Simple Interest Maths Genie, and it would instantly provide the interest amount.

Why Use the Simple Interest Maths Genie?

The Simple Interest Maths Genie offers several benefits, particularly when it comes to accuracy, convenience, and time-saving. Here are a few reasons why you should consider using this tool for all your simple interest calculations:

1. Accuracy

Manual calculations can sometimes lead to errors, especially when dealing with large amounts or long time periods. The Simple Interest Maths Genie ensures that your calculations are accurate every time, removing the risk of mistakes.

2. Time-Saving

Rather than spending time manually calculating the interest, the Simple Interest Maths Genie provides instant results. This is especially useful for busy individuals, students, or professionals who need quick and reliable answers.

3. Ease of Use

The tool is simple to use, with a user-friendly interface that anyone can navigate. You just need to input the relevant data, and the genie will handle the rest.

4. Learning Aid

For students and anyone learning about simple interest, the Simple Interest Maths Genie is a fantastic educational tool. It allows learners to quickly verify their manual calculations and better understand the concept of simple interest.

5. Versatility

The Simple Interest Maths Genie is useful for a variety of financial scenarios, including personal loans, investments, savings accounts, and more. It can be used by individuals, businesses, and financial advisors alike.

Real-World Applications of Simple Interest

Simple interest is used in many real-world scenarios, especially when it comes to personal finance and business. Some common applications include:

1. Personal Loans

When you borrow money, the lender often charges interest on the loan amount. The Simple Interest Maths Genie helps you calculate the interest you’ll owe based on the terms of the loan.

2. Savings Accounts

If you deposit money into a savings account with a fixed interest rate, the Simple Interest Maths Genie can calculate the interest you will earn over time.

3. Investments

Investors can use simple interest to estimate the return on their investments. Whether it’s a fixed deposit or a bond, the Maths Genie makes it easier to evaluate potential gains.

4. Car Loans and Mortgages

For individuals purchasing a car or a home, simple interest is often applied to the loan. The Simple Interest Maths Genie can assist in determining the total interest paid over the life of the loan.

5. Business Loans

Businesses that take out loans also rely on simple interest to calculate the costs associated with borrowing. The Maths Genie provides an easy way to determine the cost of borrowing funds for business expansion or operations.

Key Factors Affecting Simple Interest Calculations

When using the Simple Interest Maths Genie, it’s important to understand the factors that can influence the calculation of simple interest. These factors include:

1. Principal Amount (P)

The principal is the initial sum of money invested or loaned. A higher principal means more interest will accrue over time.

2. Interest Rate (R)

The interest rate is usually expressed as an annual percentage. A higher interest rate leads to more interest being paid over time.

3. Time Period (T)

The time for which the money is invested or borrowed plays a critical role in the calculation. The longer the time period, the more interest will be earned or owed.

Advantages and Disadvantages of Simple Interest

While simple interest has its advantages, it’s essential to understand its limitations as well. Here’s a look at both sides:

Advantages of Simple Interest

- Easy to Calculate: Simple interest is straightforward and easy to compute, even without advanced tools or knowledge.

- Predictable: The amount of interest is fixed and doesn’t change over time, making it easy to plan.

- Ideal for Short-Term Loans: Simple interest is often used for loans with shorter durations, such as personal loans or car loans.

Disadvantages of Simple Interest

- Doesn’t Compound: Unlike compound interest, simple interest doesn’t accumulate over time. This means you may not earn as much on your investment in the long run.

- Limited Flexibility: For long-term loans or investments, simple interest may not be as beneficial compared to compound interest.

Conclusion

The Simple Interest Maths Genie is an invaluable tool for anyone who deals with interest calculations, whether it’s for personal loans, savings, or investments. It makes the process faster, easier, and more accurate, freeing you from the hassle of manual calculations. Understanding simple interest and using tools like the Simple Interest Maths Genie can help you make better financial decisions, whether you’re an individual trying to manage your money or a business professional navigating complex financial scenarios. By knowing how to calculate simple interest, you’ll be better equipped to make informed decisions and achieve your financial goals.

FAQs

1. What is simple interest? Simple interest is a method of calculating interest on a principal amount over a set period of time at a fixed rate.

2. How does the Simple Interest Maths Genie work? The Simple Interest Maths Genie calculates simple interest based on the principal, interest rate, and time period you input.

3. Can the Simple Interest Maths Genie calculate total repayments? Yes, it can calculate the total amount to be repaid by adding the principal to the interest.

4. Is simple interest always used for loans? While simple interest is common for short-term loans, some loans (such as mortgages) may use compound interest.

5. How can I use the Simple Interest Maths Genie for savings? You can input your initial deposit, interest rate, and time period to calculate the interest you’ll earn on your savings.